Your Q1 2024 deadlines for the diary

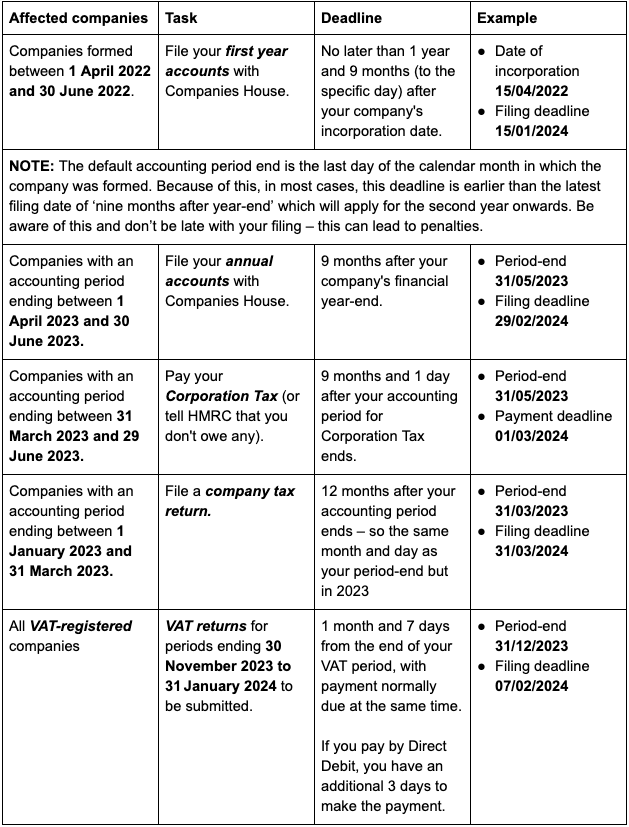

We always aim to keep you up to date with the most pressing dates and deadlines for your business diary. To help you get prepared and on the ball, we’ve highlighted some of the forthcoming deadlines for Q1 of 2024.

NOTE: If your company’s accounting period is longer than 12 months, the first tax payment deadline is normally 21 months and 1 day after your accounting period started, and the second one is 9 months and 1 day after your accounting period ends.

For example, a company with an accounting period running from 01/06/2022 to 30/09/2023 will pay the first tranche of corporation tax by 01/03/2024 and the balance by 01/07/2024

If your profits are more than £1.5 million, then tax is payable quarterly with two payments before the end of your accounting period and two after. The first payment is normally six months and 13 days after the start of the period, with the others three-monthly from that point.

Some general deadlines to plan for:

- End of personal/payroll tax year: 5th April 2024, but practically speaking, for monthly payrolls the last one processed in the tax year is to 31 March 2024

- Enterprise Management Incentives Scheme notice of options granted: within 92 days of grant

- Final date to submit self-assessment tax return online for personal tax: 31 January 2024.

- Make Capital Gains Tax payment for 2022/23 tax year: 31st January 2024 (60 days after completion for gains re residential property)

- Make first payment on account for 2023/24 personal tax and balancing payment for 2022/23: 31st January 2024

- PAYE and National Insurance Payments due:

19th calendar day of the month

after end of month or quarter as applicable (22nd for electronic payments)

Talk to us about hitting your deadlines

Where we carry out the related activities (e.g. payroll processing), we’ll be monitoring your deadlines automatically – but don’t forget that you remain legally responsible.

Monitor your deadlines and check the upcoming dates for all relevant activities. Pay particular attention to those where we don't carry out the task for you. Failing to meet a compliance deadline can result in fines and penalties, so it’s good practice to keep everything on time.

Get in touch to discuss your deadlines.